The Economic Indicators Dashboard update this month paints an uncertain picture for commercial real estate. The continued decrease in demand for office space as well as a low vacancy rate in the industrial market are sources of concern and mixed expectations about office and industrial space availability in 2023. Despite high uncertainty and economic challenges, both office and industrial vacancy rates remain lower in the Charlotte market at the end of last year compared to the nation.

Office vacancy rate

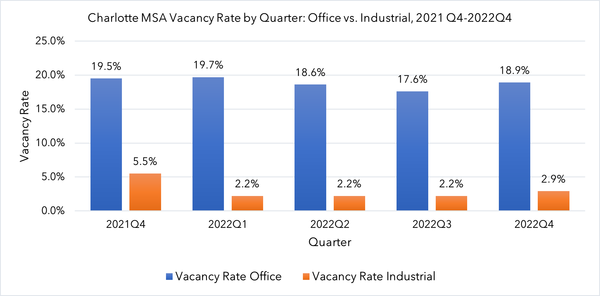

The year ended with a total vacancy rate of 18.9% in the Charlotte office market, lower than the last quarter of 2021, and the national vacancy rate (19.6%). The office market is crippled with overbuilding and surplus as challenges about office leasing remain due to changes in the post-pandemic workforce. Consolidation of office spaces and rising capital costs also increased vacancy rates. As a result, office occupancy activity is chameleon-like in its slow pace and ever-changing dynamics. Some companies like Centene and Robinhood announced a reduction in their physical footprint. The Charlotte office market recorded a negative net absorption of more than 420,000 square feet by half of 2022 followed by a year-end recovery. Demand remained weak throughout the year; however, it was stronger in the region’s urban core (e.g. Uptown, Noda, South End) with a lower vacancy rate of 18.7% than in its surrounding areas (19.1%).

With most companies still implementing a hybrid work policy to keep employees engaged in the office space, existing and incoming companies, like Armstrong Transport Group and ACC, are planning to expand or have offices in the Charlotte market.

Fig1. Charlotte Office & Industrial vacancy rates*

Source: JLL, CLT Alliance Analysis, 2023 |*Full data on Economic Indicators interactive dashboard: access data on vacancy rate, asking rent, total absorption over time, and square feet under construction for office and industrial real estate in Charlotte

Industrial vacancy rate

Charlotte MSA has a history of low vacancy rates in the industrial real estate market. It was 2.5% in Q4 2022, which is below the nation’s rate (3.4%). A low vacancy rate is a potential signal for strong economic growth as well as construction challenges. Factors including fast population growth, low corporate tax, connectivity to the country and the world, proximity to transportation hubs and coasts, and strategic infrastructure are bringing in more company habitation. About 84% of located projects require industrial space, with nearly 12% in warehousing. Charlotte experienced strong growth in the warehousing sector, adding 10,000 jobs from 2020 to 2021. Additionally, there was increased warehouse construction nationally because of an increase in e-commerce during the pandemic; however, the momentum eased amid the economic crisis.

Industrial space under construction grew by 64% from Q4 2021 to Q4 2022, which coincided with a positive net absorption and the closing of more than 17.5 million square feet, the vacancy rate is still below historical average. High interest rates, rising material costs, supply chain issues and overall market volatility are still affecting industrial construction projects and tenant demand.

New approaches to the supply/ shortage crisis?

Office and industrial vacancy rates suggest a surplus of office buildings and a shortage of industrial space. Investors, leaders, and policymakers are expected to solve a crisis with another crisis by repurposing vacant office buildings into residential communities as a potential solution to the affordable housing crisis. Further, reviewing commercial zoning regulations and providing appropriate incentives are critical to keep the construction activity momentum going for industrial real estate.

Other indicators

For a complete look at all of the key economic indicators determining regional economic health and vibrancy, including labor force, unemployment, job postings, consumer confidence, real estate, and tourism and air travel, visit the Charlotte Regional Business Alliance’s Get the Data web page, and keep an eye out for the next update here in the CLT Alliance Digest next month.