Assessing the Charlotte Region’s economy the first half of 2023 shows the second half of the year must be solution-driven with a focus on adjusting to shifts in the labor force, understanding and adapting to the fast-paced growth of AI, as well tempering the affordable housing crisis.

The year started off with a cautious tone for the economy. The Charlotte Region’s economy was swimming in a pool of uncertainty with the rest of the nation. Speculations of recession loomed over businesses and households’ decisions due to the persistent housing crisis, shifts in workforce with hybrid/remote work, and in technology with the power of artificial intelligence (AI). The tax hikes from the Federal Reserve are producing streaks of hopes for disinflation and better consumer confidence. While it is too soon to declare a soft landing, the Charlotte Region is performing at a resilient and steady pace, and disinflation without recession is possible.

Employment and future of work

Despite a slight uptick from the April rate (2.9%), workers in the Charlotte Region continue to enjoy low unemployment with May ending with an unemployment rate of 3.2%. The region also continues to outpace the national unemployment rate (3.4%). The Charlotte Region’s low unemployment rates can at least be partially attributed to being strategically located in two states that are historically desirable locations for doing business. Both North and South Carolina are setting records with more people working than ever before.

With unemployment at record lows, workers are thinking about flexibility, work-life balance, and where they want to spend 40+ hours every week. According to Kastle’s weekly back to work barometer, during the week of 7/31/2023, the average office occupancy was 49.2%. Office occupancy peaked at 58.3% on Tuesday and fell to 32.1% on Friday. Considering office occupancy numbers, it’s clear that workers currently prefer at least a hybrid setup.

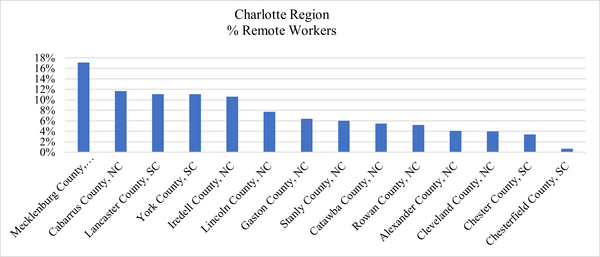

The Charlotte Region also sees its fair share of remote and hybrid employees. The chart below displays the percentage of remote workers in each county, with the remaining percentages being split between full-time office and hybrid workers.

However, there is beginning to be a push back to the remote and hybrid lifestyles many workers have become accustomed to since the COVID-19 pandemic. The Wall Street Journal captured sentiment among bosses across the country that want their employees showing up in the office. Citing culture, collaboration, and team engagement, many managers feel there is something missing when workers are out of the office. While workers are being employed at record high rates, their companies are beginning to desire a return to pre-pandemic standards of work. Going forward, both sides of the relationship will need to consider current economic conditions, team needs, and personal needs when determining the best path for compromise.

Housing affordability/Homeownership

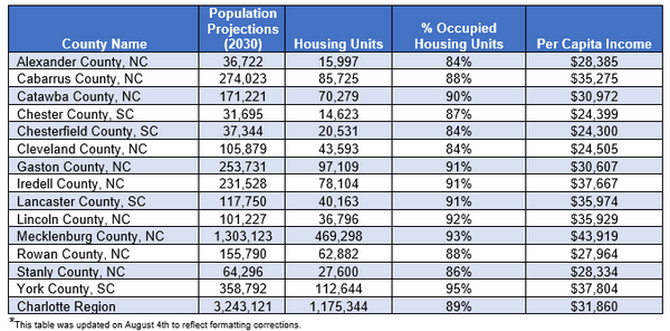

While the Charlotte Region started the year as the top hottest housing market hub in the nation, the area is no stranger to the housing crisis in the nation. The regional population is projected to be more than 3.2 million by 2030. Based on this projection, and considering the average household size (2.5 people per household), preliminary results of the Charlotte Regional Business Alliance’s analysis of housing needs demonstrate the region will need an additional 120,000 housing units, for a total of 1.3 million housing units by that period.

The housing market remains tight due to low inventory and supply, high borrowing costs, and mortgage rates. While median sales decreased slightly from $400,000 to $389,000, prospective homeowners are still waiting for rates to improve, thus showing evidence of fewer home closings. Inventory decreased by 12.7% and the region has 1.4 months of supply compared to 1.3 months of supply in the same period last year. Home sales declined 22.1% year-over-year in June 2023, as 4,161 homes sold, compared to the more than 5,300 homes sold at this period last year. In the region, Lincoln (9%) and Chester counties (65%) show positive year-over-year closings rates for single-family and multi-family (condo and townhomes) sales (Canopy MLS, June 2023).

Table 1: Population projections, homeownership, and income in Charlotte Region

Source: ACS, 2020, 5-year estimates, Lightcast, Charlotte Regional Business Alliance Analysis, 2023

What to expect

Office to residential conversions has been one of the solutions most mentioned throughout half of the year. Due to the surge in interest of office to residential conversions created by remote/ hybrid work, the U.S. Department of Housing and Urban Development (HUD) released a notice of funding opportunity to study office-to-residential conversions. While this initiative will help solve the housing crisis partially, it may not apply to all communities or all buildings and will not be a one-size-fits all approach to the crisis. In addition to considering incentives, zoning and local rules are essential to implement this initiative in the region. Considering these factors, few conversions could be possible in the Charlotte Region (more than 60% of vacancy rate in the Charlotte market is concentrated in 10% of buildings). More affordable homeownership grants for developers, and socioeconomic conditions could help reduce the crisis. Earlier in the year, the City of Charlotte started considering affordable housing projects from nine developers amounting to $26 million to fill in the housing gap.